Last Monday, I decided to sell my Apple (AAPL) shares and book a more than 30% gain. I was attracted to Apple in the second half of last year when the stock price plummeted with the decision by the management to discontinue reporting unit sales figures. At that time, I saw a clear mismatch between the price and the value of shares. Deciding to sell my holding does not imply that I no longer believe that Apple is a great company. On the contrary, I use a couple of Apple devices and I’m sure that I would never think about getting rid of these devices unless otherwise to replace these with another Apple device. However, I find the valuation metrics dubious at present and I’m no longer confident whether I’d be able to sleep well at night with Apple still in my small portfolio of investments.

I prefer investing in small-cap stocks because there are many high-growth companies that receive little to no attention from investors. This leads to massive disparities between the value and price of such small stocks at times, presenting great investment opportunities. However, I would not hesitate to invest in a large-cap stock when I spot the same characteristics – hence the investment in Apple. I now think Apple shares have appreciated so much to an extent where future growth is already factored in, or maybe even more growth than Apple would ever achieve.

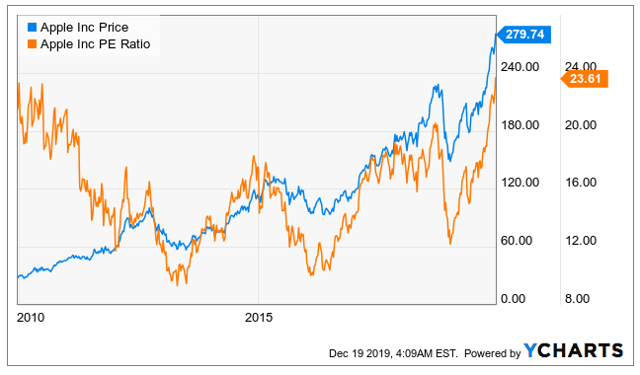

Apple is currently trading at a 10-year high price-to-earnings ratio. As illustrated in the below chart, the earnings multiple has expanded exponentially in the last year or so, along with the appreciation of share price.

Chart 1

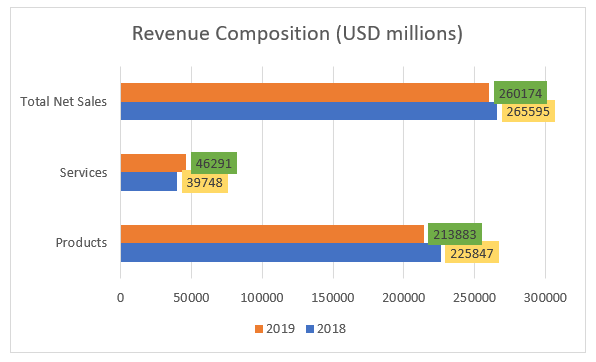

The earnings multiple, however, does not represent the true state of company affairs, in my opinion. Apple reported better-than-expected earnings for its fourth fiscal quarter and reported a record EPS of $3.03. Services revenue reached an all-time high of $12.5 billion in the quarter. However, none of this can hide the fact that revenue declined 2% for the fiscal year and the 7% decline of net income. Not surprisingly, Apple could not offset the decline from its product sales with the growth of services revenue.

Source: Company filings

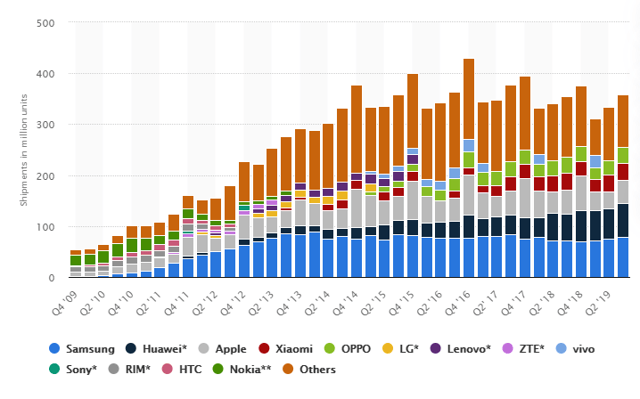

That said, the company was able to turn things around in the fourth quarter and report an increase in revenue over the corresponding period in the last year. Still, I’m not convinced of Apple’s ability to offset the expected decline in product sales in the next 5 years, resulting from very slow growth in worldwide smartphone shipments. Since peaking in the fourth quarter of 2016, smartphone shipments have declined.

Source: Statista

If ever there was a time in the recent past when Apple shares should have traded at a PE of above 20, I think it should have been just before the release of the revolutionary iPhone 6. Right now, shares are trading at an even higher multiple than it did right before the release of the first-ever iPhone 12 years back.

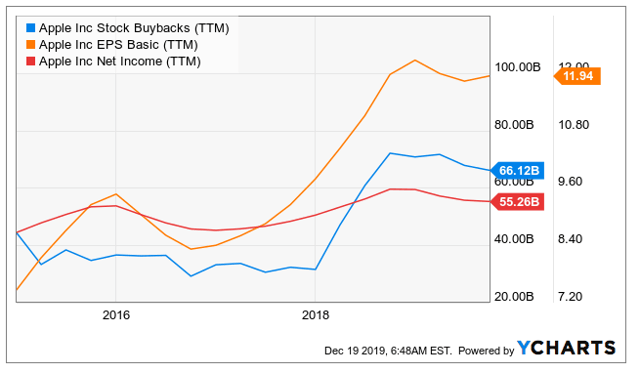

The next chart might come as a surprise to investors as this is one of the most-used charts by analysts to portray the benefits of investing in Apple shares.

Chart 2

The net income has literally gone nowhere in these 5 years but the EPS has increased substantially, supported by share buybacks. While I agree that buybacks could add significant value to investors and would prove to be an additional source of income, as a growth investor, I like to put my money behind companies that are not engineering EPS growth through buybacks but does it the hard way by bringing in higher earnings year after year. This is the second reason why I sold Apple.

Apple uses cash for these buybacks, which is certainly a good thing for investors. From a mathematical perspective, using excess cash to fund buybacks after allocating sufficient capital to growth operations is accretive to EPS as cash sitting in a bank account earns next to nothing. I believe that it’s the right decision to distribute cash to investors via buybacks. However, I would have rather enjoyed it more if Apple had much better plans for their cash, as it had for the majority of the last decade.

Conclusion

I am not bearish on Apple’s prospects. My investing philosophy is simple – buy when there’s a margin of safety and sell when it disappears. Whether Apple shares would go higher or not in the next few months will depend on whether the company will have a blowout first quarter and the progress of trade negotiations between the U.S. and China. In the long term, shares will follow earnings, like it always does. The margin of safety that I found in Apple shares in the latter half of 2018 seems to have disappeared with the significant capital appreciation in this period. I decided to sell AAPL because that’s the right decision for me based on my philosophy, risk tolerance, and return expectations. If the company gets everything right, I’m sure that my decision to sell would be proven wrong and that investors would realize a nice return even from these prices. Rather than trying to get some more juice from my investment by taking this risk, I decided it’s best to look for another company that would give me a 30% return in the next 12 months as AAPL did.

I prefer to end this article with a quote from Charlie Munger.

“No matter how wonderful a business is, it’s not worth an infinite price. We have to have a price that makes sense and gives a margin of safety considering the normal vicissitudes of life.”

If you enjoyed this article and would love to get notified when I publish my next research piece, please leave your e-mail address above.