When Andrew Left speaks, the market listens. Time and again, we have witnessed high flying stocks getting reality checks in the form of short reports issued by Citron Research, one of the most recognized short sellers in modern history. This time around, DoorDash, Inc. (DASH) is at the receiving end. The stock fell on Dec. 17 as Citron released a short report assigning the stock an intrinsic value estimate of just $40, implying a downside risk of over 73% from the current market price of around $151. Due diligence is key to be successful in stock market investing, and the best course of action therefore is to validate whether Citron is most likely correct in its valuation assumptions about DoorDash. After carefully analyzing many variables including the market-leading position of DoorDash in the United States, growth prospects, near-term catalysts, and the current valuation level, it seems reasonable to conclude DoorDash is setting up to hurt investors big time.

Citron Research: hits and misses

Many investors have heard of Citron Research, but not many dig deep to evaluate its historical performance. Even though market participants need to be forward-looking, the best way to gauge a measure of an investment manager’s success is to look back.

In 2015, the Wall Street Journal conducted a study by analyzing 111 short reports published by Andrew Left (who runs Citron Research) from 2001 to 2014 and found out that the stock price of the companies covered has declined, on average, 42% in the year following the short report. Investing in the stock market and successfully turning up a profit is difficult, but it is even more difficult to be a short seller who consistently beat the market, and Mr. Left’s track record is stellar.

Does this mean investors should follow Citron Research into and out of stocks every time a new report hits the market? Absolutely not!

Similar to many professional investors, Citron Research has got some calls spectacularly wrong. The best example is its short report on Tesla, Inc. (TSLA) that was initially published in September of 2013. The below is an excerpt from this report.

Citron could probably write another 100 pages about the challenges facing Tesla over the next 5 years. If you are a shareholder and you believe that the company will have an unobstructed rocket ride from here over the rainbow, you might be rewarded with a 20% gain from its current value. But, if anything goes wrong, or even stays status quo, you are in for a tsunami of hurt, as the stock is perched at a level of extreme unsustainability.

Tesla stock has beaten the S&P 500 index handsomely ever since this report was published, which goes on to confirm that even the best in the business will eventually get it wrong, which I believe is a universal truth.

Now that I believe investors have a clear idea of the type of research company that we are dealing with and its historical performance, let’s move on to see whether DoorDash indeed is overvalued. I will start by summarizing Citron’s thesis for the company.

The main points from the short report

When it comes to a research report of any sort, the best thing to do is to read the entire document from A to Z. In case you are time-constrained to read Citron’s short report for DoorDash in its entirety (for which I have included a web link at the beginning of the article), here are the reasons why Citron is bearish on the food delivery company.

- The valuation does not seem to make sense.

- The competition in the market is high, and this will put pressure on margins.

- Growth has already peaked as a result of the stay-at-home economy and the industry will soon be seeing lower growth rates.

- There are better bets in the market for tech investors than a highly commoditized food delivery business.

In the following segments, I will try to determine whether there is any substance to these claims. Since valuation is often the last step of the analysis process, I will leave that to the end.

The outlook

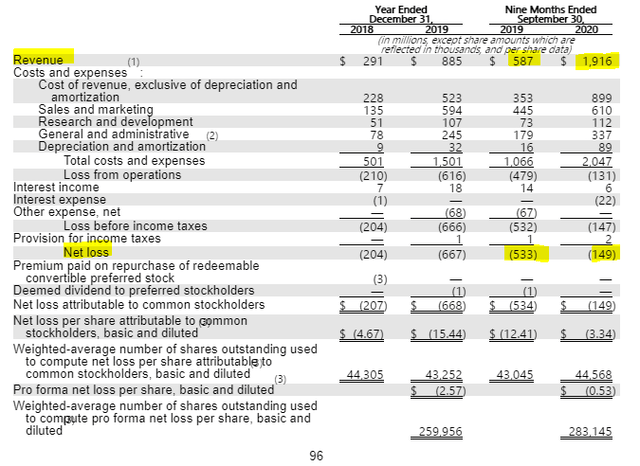

There is no doubt about the fact that Covid-19 has accelerated the growth of the food delivery industry by a few years. This helped DoorDash grow its revenue for the first 9 months of this year by over 200% in comparison to the corresponding period last year. Even on the back of this stellar growth, the company failed to turn up a profit.

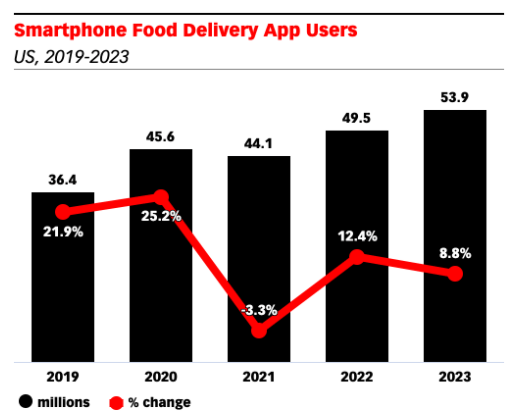

The loss narrowed, but considering the possibility that sales will see a slump in the coming months once normalcy prevails, there is no reason for investors to be excited here. Another important factor is that comparable sales might exhibit a drastic drop in the latter half of next year assuming the risk of Covid-19 will subside by then. This is certainly not good news for investors as such a development could trigger a selloff in the market. The market research firm eMarketer projects a decline in the total number of food delivery app users next year, and I believe the actual numbers could be far worse.

Source: eMarketer

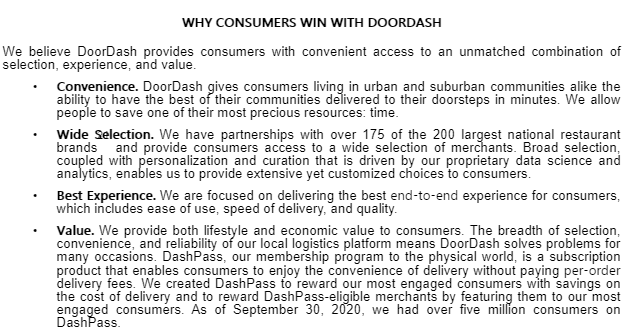

Another factor that would limit the ability of DoorDash to generate economic profits is its undifferentiated business model. In all fairness, none of the food delivery companies can develop any customer stickiness because consumers tend to go for the best offer on any given day. Building an economic moat, or competitive advantages in other words, is extremely difficult, if not impossible in the food delivery industry. Because of this characteristic, pricing mechanisms become the main differentiator between one delivery partner and another, and this price-based competition is always a bad sign for a company and investors as operating margins are highly unlikely to recover meaningfully on a permanent basis in an industry that is characterized by price-based competition. The below excerpt from the prospectus filed with the SEC was meant to provide investors with an idea as to why DoorDash will succeed. But to me, this goes on to raise an important question: how is DoorDash different from its competitors?

Source: Prospectus

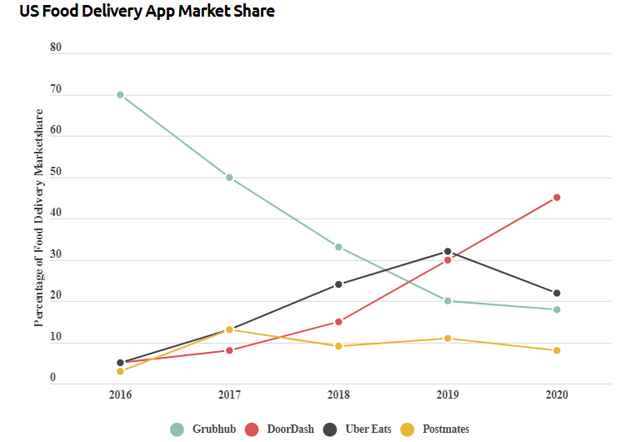

Finally, an investor needs to look at the competitive landscape of the food delivery industry. As illustrated below, DoorDash currently has a market share of about 45% in the United States and is the leader of the pack.

The market-leading position might entice an investor to believe DoorDash is well-positioned to benefit from the expected growth of the industry, but consolidation is a key theme in this business sector. Many of DoorDash’s competitors are actively pursuing inorganic growth opportunities, whereas DoorDash confirmed in its prospectus that there are no such plans at the moment. One other factor that troubles me is the inability of this industry to turn up profits. A market-leading position in a loss-making industry, if you ask me, does not mean anything for shareholders unless otherwise the company is positioning itself to use its market leadership to thwart the threat of competition in the long run. DoorDash, for the moment, does not seem to be going down that path.

Valuation: I couldn’t have agreed more with Citron

DoorDash is currently valued at close to $50 billion in the market, whereas Grubhub, Inc. (GRUB) has a market share of approximately half that of DoorDash in the United States has a market cap of just $6.5 billion. Uber Technologies, Inc. (UBER), on the other hand, is valued at close to $90 billion and food delivery represented around 15% of company revenue in 2019, and the massive market cap is largely attributable to its global leadership in the ridesharing industry. These numbers alone are enough for an investor to conclude that DoorDash is significantly overvalued.

To be on the safe side, however, we can look at even more numbers.

If DoorDash brings in $2.92 billion in revenue for fiscal 2020, which is the current consensus estimate, and then grows its sales by 35% in the next year, sales would hit $3.9 billion by December 2021. This, as far as I believe, is a very optimistic scenario and does not take into account the imminent drop in online food ordering. These optimistic numbers imply a forward price/sales of close to 13 at the current market price. Here’s how this compares to its closest rivals.

| Company | Forward Price/Sales ratio |

| Grubhub | 3.6 |

| Uber | 7 |

Source: Seeking Alpha

Uber deserves a higher multiple considering its global leadership in the rideshare industry, and even from a food delivery perspective, Uber has what it takes to become a truly global giant even though margins will not be supportive of strong earnings growth. DoorDash, as a pure-play delivery company, is trading at a valuation level that is not sustainable in the long run, and its valuation is not a true representation of what the future holds for the industry as well.

But is it a must to be profitable to boast a multi-billion dollar market cap?

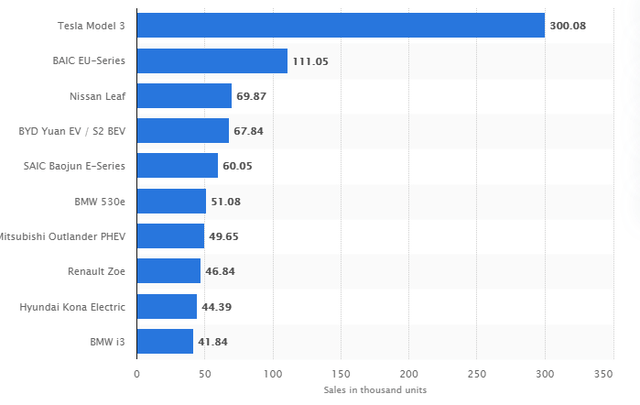

The rise of Tesla and a few other companies that have an appealing story behind their business model have led some investors to ignore corporate earnings. Tesla, for instance, became the most valuable automaker in the world in July, even though the company is selling just a fraction of the number of vehicles sold by companies such as Toyota Motor Corporation (TM) and is a country mile behind from an earnings perspective as well. Does this mean it’s the new normal, meaning DoorDash deserves to trade at the current valuation level even though its earnings might never justify this?

I beg to differ.

Tesla is operating in a niche market, and there are many tailwinds to support its story. First, policymakers around the world have realized the importance of reducing carbon emissions, and this creates a demand for EVs. Second, Tesla is the undisputed leader in the EV industry in key markets including the United States. The below chart gives an indication of Tesla’s dominance in the U.S. in 2019.

Third, Tesla has a vocal CEO who is a driver of the company value. Even though it’s difficult to quantify the positive impact in the market for a bigger-than-life CEO/Chairman, there is definitely some correlation. Elon Musk has over 40 million followers on Twitter, and Tim Cook has just 12 million followers in comparison. Even though this is by no means a measure of the impact a CEO would have on the market value of a company, it gives some indication of the grip Tesla CEO has on investors and consumers.

Finally, the electric vehicle industry is a market that is expected to grow exponentially in the coming years. Deloitte projects this industry to grow at a healthy CAGR of 29% through 2030 as electric vehicles become mainstream in both developed and emerging regions of the world. In comparison, the online food delivery market is projected to grow at an annualized rate of 7.5% through 2024. The underlying growth prospects for the two industries, therefore, are significantly different.

DoorDash, arguably, has none of these tailwinds behind the company. Even though it had a leading position in the U.S. food delivery market in 2019, consolidation in the industry (think about Uber gobbling up Postmates) has led to a more concentrated market, and consolidation will continue to be a feature because of razor-thin margins at which the leading players are currently operating.

Takeaway

Momentum is key when it comes to short-run returns, and this is on DoorDash’s side for the moment. Even though I did not expect the stock to trade as high as it did on the first trading day, I expected DoorDash to have a nice run in the market during the first few months of trading because of the favorable macroeconomic conditions. Investors adore growth, and the company reported eye-popping growth thanks in part to the millions of users who came online to order food for the very first time in their lives due to mobility restrictions. The party, however, will eventually come to an end, and DoorDash will be faced with modest growth, and the current valuation could not have been far from this economic reality.

As a parting thought, I’d like to encourage readers to guess (in the comments section) why I selected the first image for this article.

The author does not have any shares mentioned in this article.

**If you enjoyed this article, please consider signing-up for Beat Billions by providing your e-mail address in the box above. You will then receive a SINGLE daily e-mail with all the articles published on Beat Billions.

**Visit us again to see what we’ve got to offer small-cap investors. We write multiple times a week.